Why HR Technology is a Good, but Not Great Category

August 7, 2017 Leave a Comment

HR Technology is a noble software category that almost everyone can rally around its mission: To improve the efficiency and effectiveness of organizations. Whether it is talent acquisition, performance management, learning or compensation & benefits, no one can dispute that technology to enable HR organizations can have real impact on people’s lives. In general, as an employee of one of the HR Tech vendors you can feel good about the problems your firm is solving for your clients because you can relate to the product or service you are selling.

The HR Tech industry is booming which can easily be seen by the number of startup companies being created every month, the growth of the HR Tech industry conferences and the record amount of funding invested in the HR Tech category. Because just about everyone has encountered some type of HR problem that needs to be solved during their career combined with the incredibly low costs of starting a SAAS business these days, everyone and their brother have started an HR Tech company in recent years to solve some piece of the HR puzzle. Many folks have dedicated themesleves to the HR Tech industry and there are certainly many opportunities to have a long career as an employee, industry expert/analyst or vendor.

However, after spending almost four years in the space, I have peeled the onion and found that it really isn’t such a great industry when it comes to profits. If you want to get disproportionate returns on your investment of time or money as an investor, founder or employee this probably isn’t the first category you would pick.

While there are clearly various pros and cons of the industry and everyone must decide what is right for their personal situation, at a macro level here are….

The Top Three Reasons Why HR Tech Is Not a Great Category:

- Unusually High Sales Friction: Hard to prove ROI in order to get budget approval

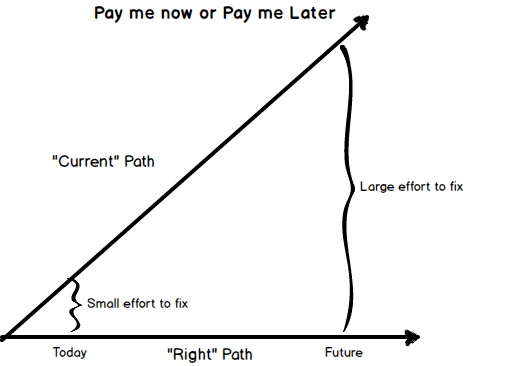

By definition, the HR function is not directly tied to revenue like sales, marketing or product; it is an enabling function. While there are some roles where there is a clear connection to revenue to filling sales-related roles (for example, professional services organizations), in the significant majority of situations it has hard to show how much more money you will make for any direct HR investment. The vast majority of HR tech investments are justified based on compliance or real cost reductions (e.g. applicant tracking systems or payroll). These types of investments are considered either ‘cost-of-doing-business’ budgets or somewhat easily quantifiable via a reduction in an existing budget. However, tools which improve productivity or quality are much harder to get approval without significant, measurable benefit data to prove the business case for a sizeable budget. This takes time, effort and commitment from a champion within the organization. Since HR budgets don’t tend to grow disproportionately to a company’s growth, most of the time getting a large budget approval for a new system is dependent on a significant change to another part of the HR budget (e.g. no longer investing in another system). At the end of the day, the sales friction for these types of quality or productivity solutions makes it harder for HR tech companies to grow quickly. During my years in HR Tech, this is consistently the most common frustration my fellow founders have echoed: not being able to close new customers at a faster rate due to the challenge of getting a piece of the HR IT budget.

- Highly competitive unless you have a moat

If you look at the most profitable companies in the Fortune 500 they have incredible scale (e.g. banks, ExxonMobil), low marginal costs (e.g. biotech) and/or are fortunate to be in a category with ‘winner take most of the profits’ economics (e.g. Apple and Google). In addition, having network effects helps create a moat which inhibits others from re-creating the scale that the winners have secured. With the odd exception (e.g. Oracle, LinkedIn), there are not many companies in the HR Tech category that have been able to build a moat and achieve disproportionate profits. While there are certainly some excellent companies who have achieved scale (e.g. ADP, Workday), their margins are good, but not great. Almost all companies in HR Tech have (or will have) competitors that provide buyers multiple options. So while there may be ‘lock-in’ to a solution for a large enterprise software platform for a few years, the acquisition costs, competitive pricing and cost-to-serve limit margins and growth potential. Network effects are pretty rare in HR tech (LinkedIn being a notable exception). The majority of IT budgets for the HR department are spent on enterprise software solutions and they usually involve traditional sales teams with big price tags and complex implementations – not viral adoption.

- Profitable but not liquid: Limited exit options

In the past 10 years, I am only aware of a handful of billion dollar exits in the HR Tech space. LinkedIn, Workday, SuccessFactors, Taleo and Kenexa-BrassRing. The limited true M&A in the space makes it challenging for traditional, big name venture capital firms to be interested in the space. If you look at most major HR tech funding announcements they do not typically include well known VCs. While there are some exceptions here and there, what I have been told the challenge in picking early winners (since HR has so many problems companies are always willing to pilot something new) combined with the lack of exit opportunity drives venture partners to prefer investing in other categories.

At least a couple of times of month I get an unsolicited email from some boutique firm offering special services to help HR Tech founders either raise non-traditional venture capital or assist with some type of creative exit opportunity for later stage companies (e.g. at least positive EBITDA or >$10M in revenue). From someone who is pretty knowledgeable with the traditional Silicon Valley startup path where you continually raise more VC funding until you either get acquired or if you are really lucky…IPO. However, what I have learned the last couple of years, it that there are literally hundreds of HR tech companies who have achieved a reasonable level of success and likely profitability, but they are tweeners who are not big enough or growing fast enough to IPO or be an acquisition target but at the same time, they have real businesses that generate positive cash flow. This creates a conundrum for the investors and any founder/long-standing employee holding a good chunk of equity about how to liquidate their shares. While dividends are certainly one option, that is usually not the preferred choice. Imagine putting in many years to build a reasonably sized going concern generating millions in revenue, but not having a clear exit path. This lack of liquidity options is something that many folks who are vested in HR Tech need to consider when committing to the category.

Conclusion

There are many factors I truly love about the HR technology industry. It starts with smart, passionate, caring folks who are committed to makes things a little better every day for the working folk. But, depending on your role, you should know exactly what you are signing up for if you are committing to a career in HR Tech. It may not be as financially rewarding as you might expect. If you are looking to hit the jackpot in HR Tech as a founder, investor or early employee, you might want to explore other options or categories before this one.